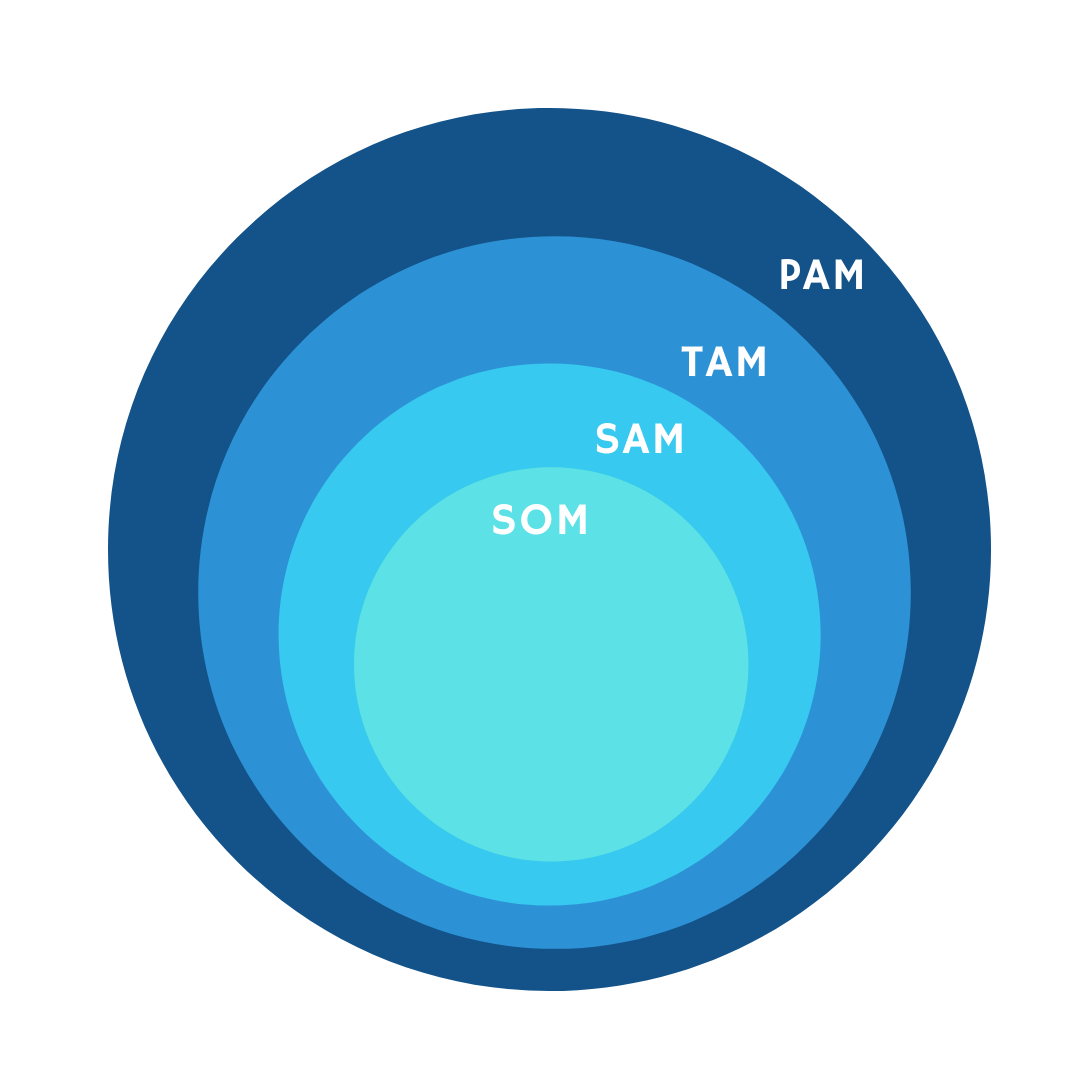

PAM, TAM, SAM, SOM – Tools for Market Analysis

Considering the excitement that comes with launching a startup, it is easy to become ambitious while setting goals and targets. If your figures are not backed by proper research, you might find yourself in a market that lacks adequate growth potential. To avoid this situation, startups must try to determine present and future market opportunities during their initial stages.

Market analysis is a thorough qualitative and quantitative assessment of the market to understand its dynamics and potential. The following aspects can be ascertained through this process:

- Present and future market size

- The growth potential of the market

- Possible distribution channels

- Market trends

- The cost structure of the industry

Proper market analysis can give your startup insights into your target audience and help comprehend the competitive landscape. You can even check and narrow down the marketing strategy that will best suit your business. When it comes to presenting results, the acronyms PAM, TAM, SAM and SOM are most commonly used. These few terms represent different subsets of the market and are extremely relevant for entrepreneurs and investors.

Given below are explanations for each of these acronyms. For a better understanding, the example of firm X is used, which sells accounting software to businesses in India.

PAM or Potential Available Market refers to the global market that exists for your product or service, without being limited by geography, logistics or other related factors. It is essentially taking into consideration every possible user.

In our example, firm X’s Potential Available Market will be the entire global accounting software market, regardless of location or other factors.

TAM or Total Addressable/Available Market is the total market demand for your product or service. This includes even those consumers who may not have the means to buy what you are selling. It is the upper limit on the maximum possible revenue that you can generate. You can get an idea of the market potential by estimating the number of customers you have and multiplying it by average revenue each of them can bring. TAM is useful in understanding the size of the market and even its future growth potential.

Let’s assume that there are 10 Lakh businesses in India, out of which 7 Lakh require an accounting software, which becomes the Total Addressable Market. If firm X sells each software at an average price of INR 20,000, then we can say that the revenue potential is INR 1400 Crore.

SAM or Serviceable Addressable/Available Market includes those customers out of the potential to whom you will actually be able to sell your product or service. The scope of TAM is too vast, and startups need to narrow down to the set of customers whom they feel they can possibly reach out to. SAM is essential because it helps in setting realistic targets.

Suppose firm X specialises in building this software for wholesale merchants, and there are 5 Lakh such merchants in the country. Out of these, 50% are interested in having an accounting software. This means that the Serviceable Addressable Market is 2.5 Lakh businesses.

SOM or Serviceable Obtainable Market is that part of SAM that you can realistically capture. This is found by keeping in mind logistics, cost and the competitive landscape. SOM is integral to generate practical and achievable sales and revenue targets and understand the startup’s worth. It is also useful in making financial projections.

In the case of firm X, let us assume that they have 100 employees. Although they can potentially serve 2.5 Lakh clients, they are limited by the strength of their workforce. Given the 100 employees, if they plan on targeting 2000 clients in 3-4 years, then that becomes their Serviceable Obtainable Market.

While PAM and TAM reflect the enormous potential that can be captured, SAM and SOM help in giving a more realistic and actionable perspective. Data can usually be collected through secondary sources such as publications, government records and even through online surveys. Market analysis is important to give the business a direction and raise funds if enough potential is found.